Solv V3.1 Update: April - May

Solv V3.1 Hits $115M in Total Funds Issued, with $600K+ Returns Delivered

Dear Solvians,

As we've been navigating through the dynamic months of April and May, we've witnessed the crypto market evolve at a breakneck speed. From the pulsating events like Consensus and Edcon to major industry developments such as Blockworks and Red Beard Ventures' fundraising, Stripe's crypto accessibility, Binance's foray into BRC-20, and the emergence of LSD and RWA - it's clear we're in the midst of an exciting era.

Just like the rapidly transforming DeFi landscape, Solv Protocol has been on an accelerating path too. In this edition of our newsletter, we'll be spotlighting our recent milestones, showcasing the stellar performance of funds managed by our top fund managers, unveiling new features of our product, and walking you through community engagements and noteworthy external features. Fasten your seatbelts - we've got an enriching journey ahead!

Solv V3.1 Issued $115M in Total Funds, with $600K+ Returns Delivered

Since our V3 launch two months ago, we’ve facilitated $115M in total funds issued. This translates to over $600,000 in returns to our investors - a testament to our thriving community's involvement and trust.

To ensure you are in the loop, let's shine a light on the top funds and their yields managed by portfolio managers:

iZUMi Finance: Issued $29M and distributed $205,000+ in returns. Their range of funds includes iZUMi Fund Senior (7% APR), iZUMi Fund Junior (31.6% APR), and others.

👉 For full report of iZUMi Finance, read here: https://lnkd.in/giD3w9JB

Binquant: Issued $25M with their Neutral Strategy Fund delivering a 4% APR.

Whale 0xbb: Managed $17M+ and distributed $59,000+. Their Delta Neutral Fund realized a APR of 4%.

Whale 0x65: Managed $15M+ and delivered $52,000+ in returns with their Market Making Fund.

CCL: Managed $8M+ and distributed $27,000+ in returns with their fund realized a APR of 4%.

Perpetual Protocol: Managed $3M and distributed $50,000 in returns. Their Perpetual-Convertible Fund realized a APR of 5%.

Here, we have in-depth profiles to share of two leading fund managers and their latest offerings.

iZUMi Finance

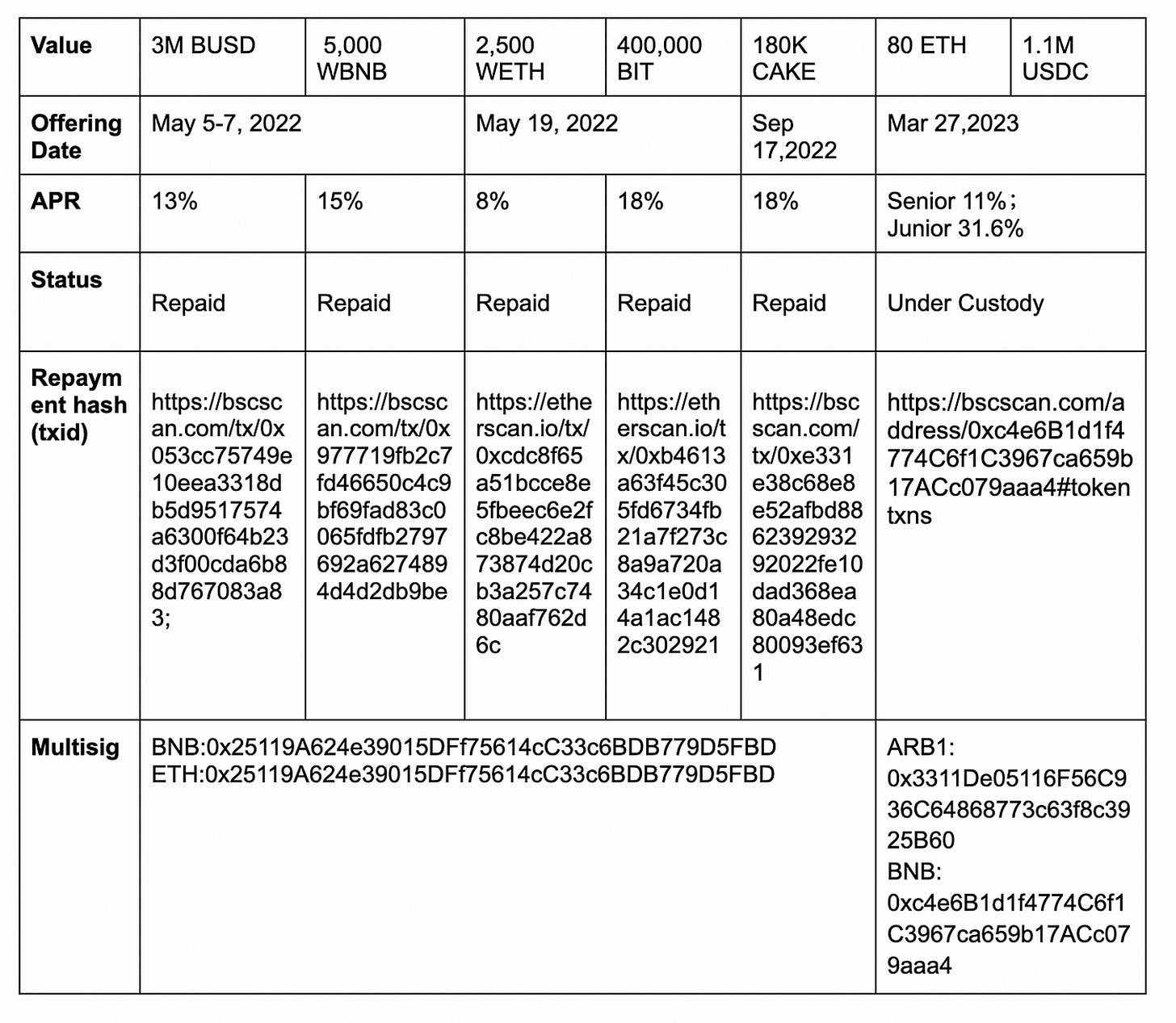

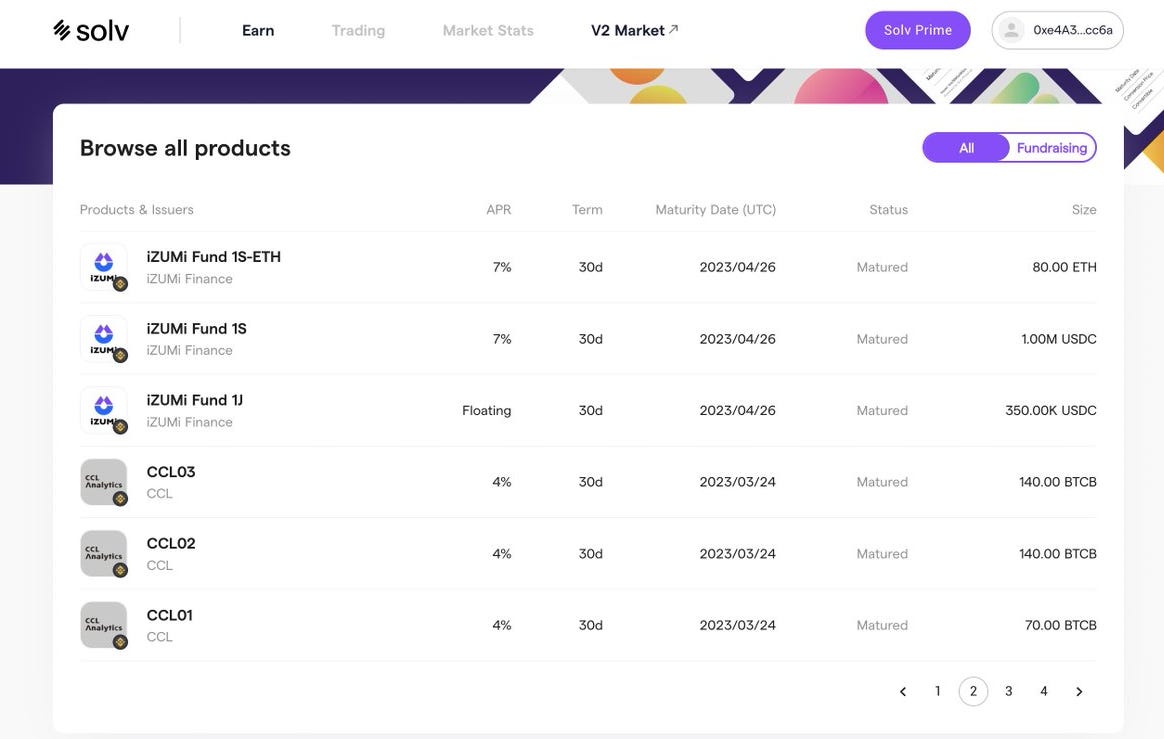

iZUMi Finance has completed four successful funds on Solv. Their latest offering, Market Making 202301 fund, has achieved impressive gains.

Performance highlights of the iZUMi Market Making 202301 fund are as follows:

Senior Tranche: Investors enjoyed a total APR of 11%, composed of 7% in stablecoins, 2% in iZi tokens, and 2% in SOLV.

Junior Tranche: Investors seeking higher yields were rewarded with an impressive 31.6% return.

Further details of the fund's performance, including NAV trends and repayment records, can be found on our Solv V3.1 page. Please keep an eye out for future iZUMi offerings.

GMX & Uniswap Market Maker Blockin

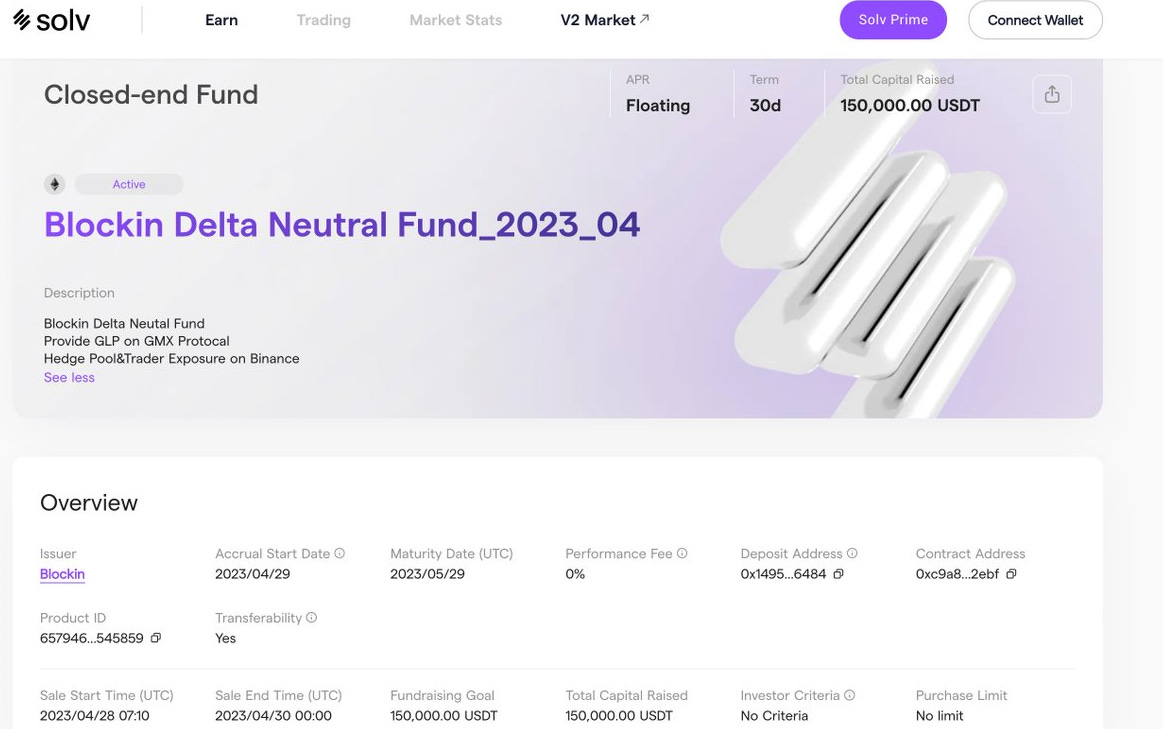

Blockin is a market-making team managing over $30M in assets. Blockin has made significant strides, notably through issuing the "Delta Neutral Fund," inviting investors to access its sophisticated delta-neutral trading strategies and enjoy real yield.

Blockin's Historical Performance:

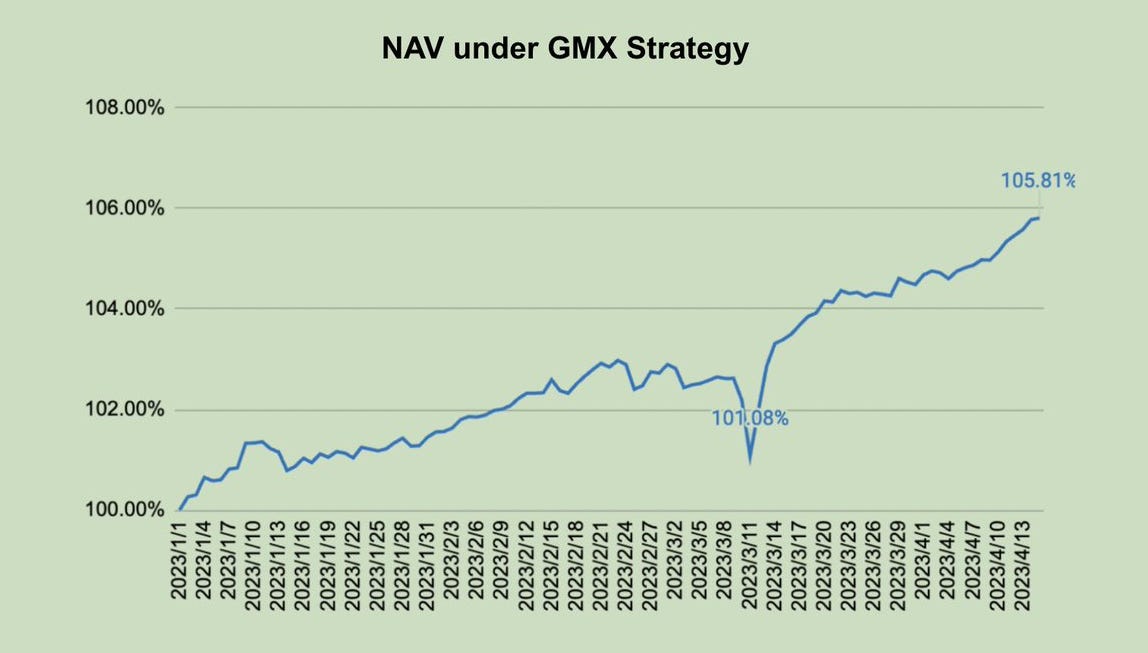

Blockin's GMX Market-Making Strategy:

Period: January 1, 2023, to April 15, 2023

APY: 20.20%

Maximum observed drop in value: -1.11%

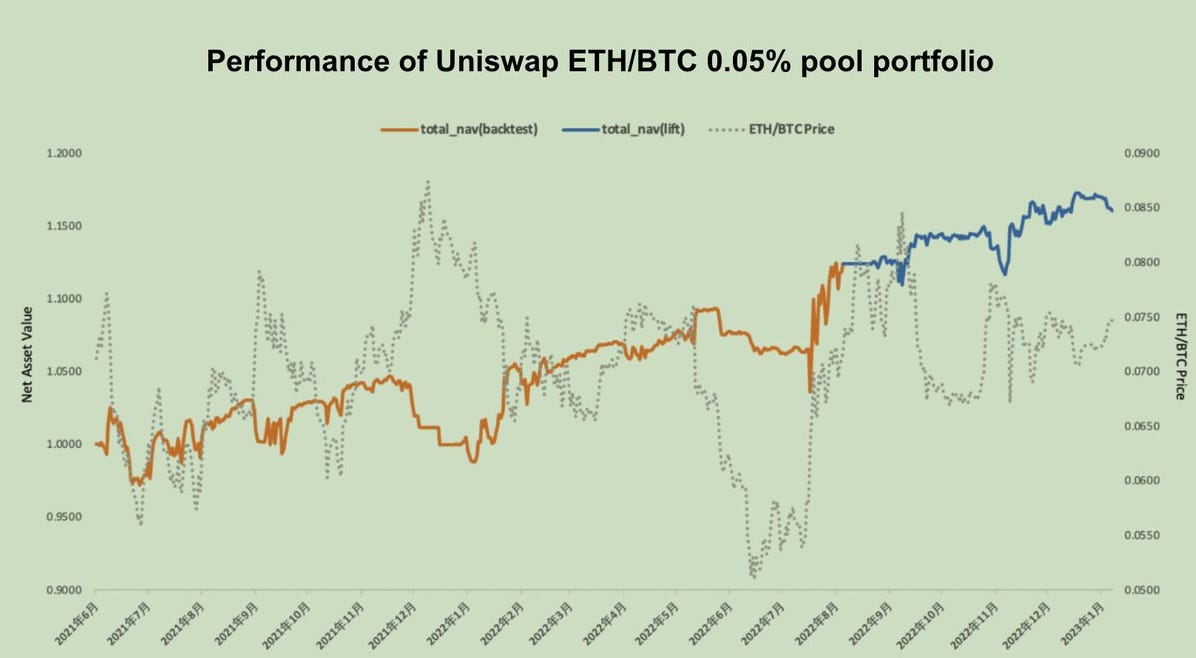

Blockin's Uniswap Market-Making Strategy:

Period: August 5, 2022, to January 8, 2023

Annual $BTC-valued return: 8.44%

Maximum observed drop in value: -3.19%

Blockin's performance speaks volumes about why their market-making funds are becoming a compelling choice. Their Delta Neutral strategy stands out, offering steady returns (up to an APY of 20%), a low-risk profile (with a maximum historical drop below 3.2%), and high liquidity (ensuring minimal slippage losses).

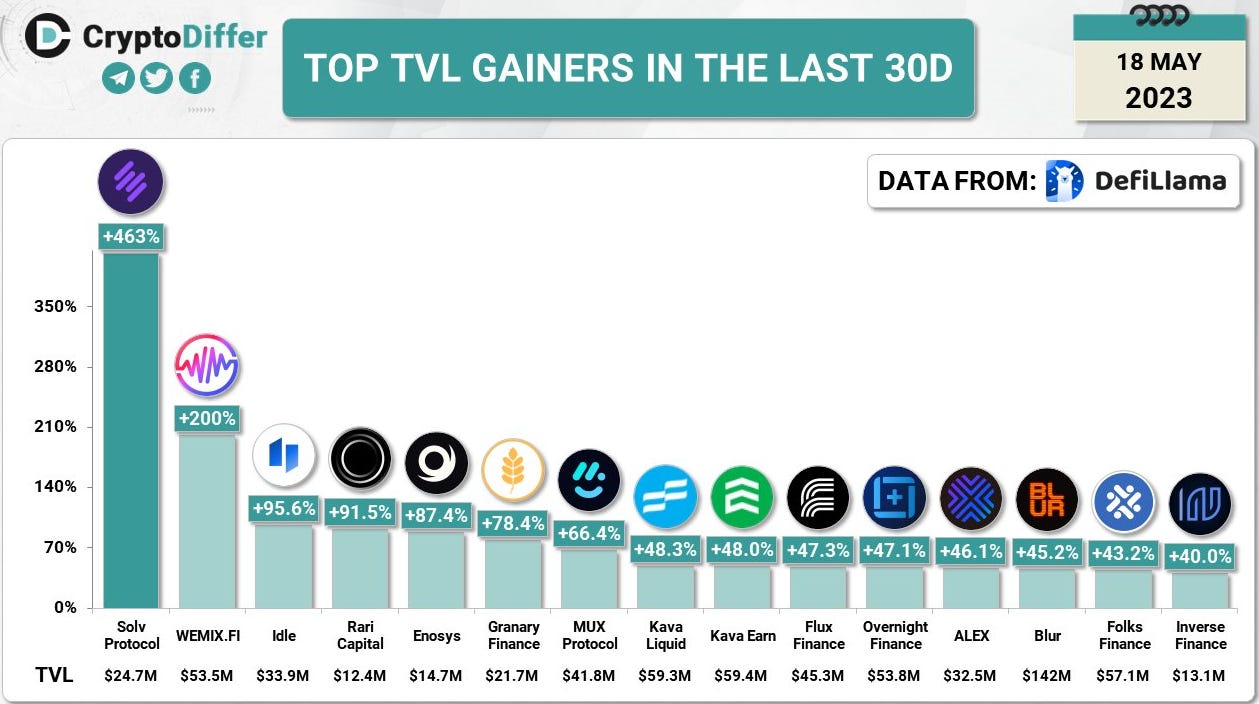

Solv’s TVL climbed to #1 on DefiLlama

With esteemed market makers such as BQ, Blockin, and iZUMi Finance raising considerable funds on our V3 platform, Solv’s Total Value Locked (TVL) has once soared by 463%, becoming the top TVL gainer on DefiLlama in mid-May.

Product Development

Solv V3.1 Launched on Arbitrum

After much hard work, our dev team has successfully launched Solv V3.1 on Arbitrum, Ethereum and BNB chain . Other exciting product enhancements and visual updates include:

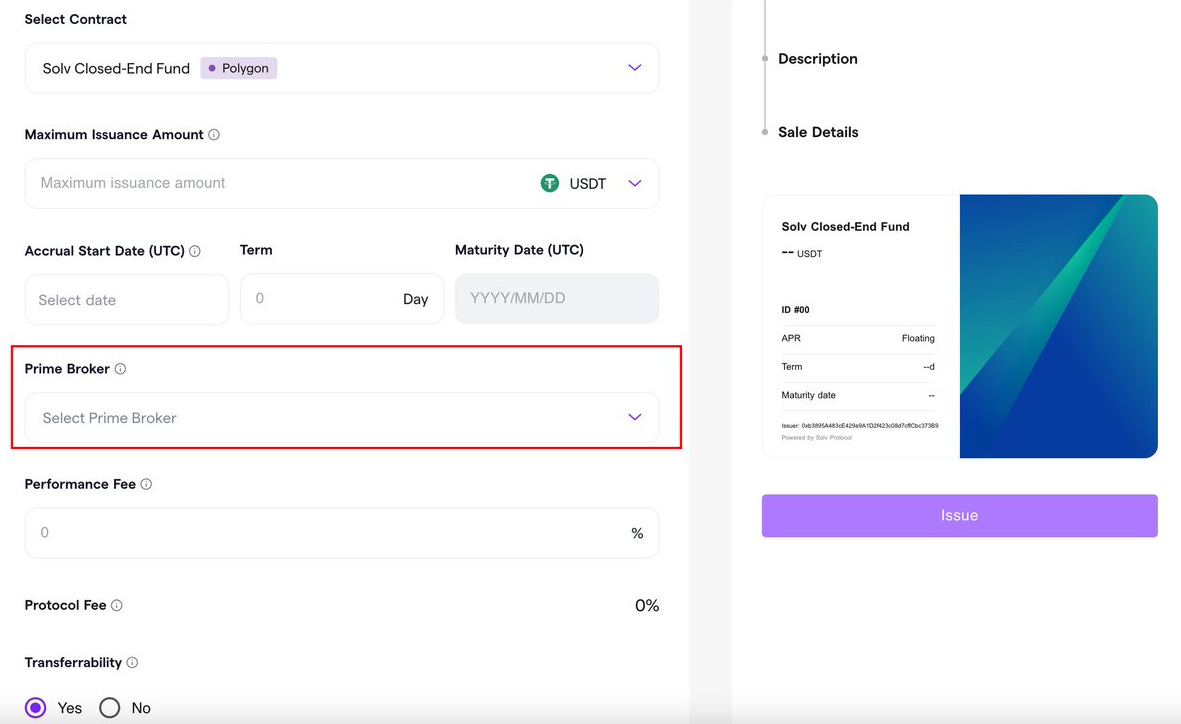

Fixed or Floating Yield-You Decide: With our upgraded smart contract, you can now opt for both fixed-yield and floating-yield funds. This offers an exciting opportunity to generate variable returns, bringing more flexibility and potential growth to your investments.

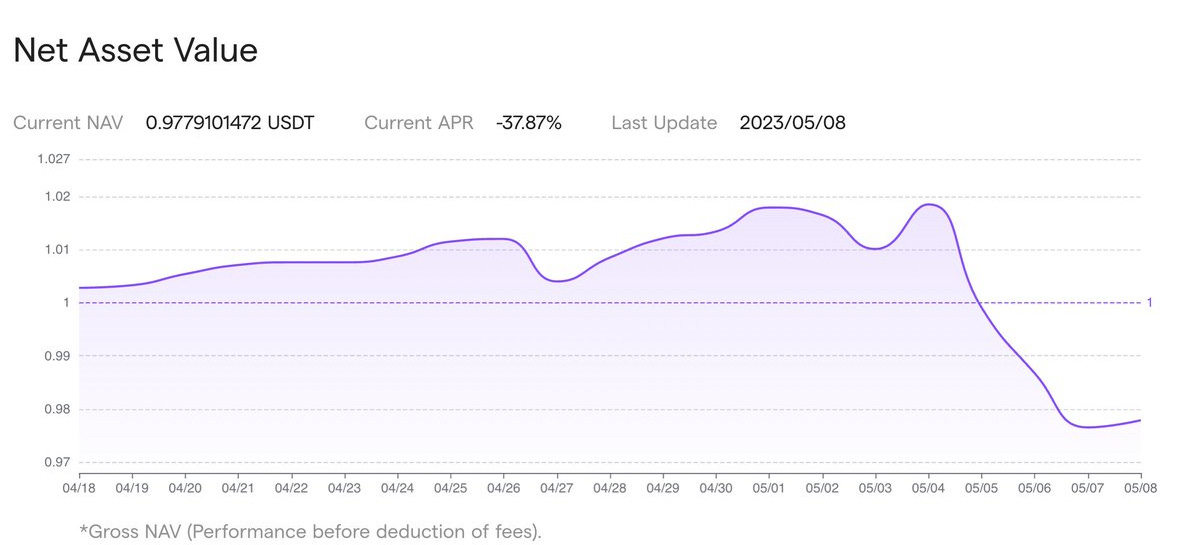

NAV monitoring at Your Fingertips: Our new interactive chart feature makes tracking your fund’s Net Asset Value a breeze. Monitor the trend of your NAV in real-time and make better-informed decisions with ease.

Safeguard Your Fund With a Prime Broker: Fund issuers can now appoint a prime broker. This new feature offers assistance with liquidation when necessary, ensuring a smoother, more efficient process.

Revamped UI/UX: We've refreshed the UI/UX on our main, purchase, and product display pages, offering you a more intuitive, user-friendly interface.

Here's to a more intuitive, efficient, and fruitful investing experience with Solv.

Community Activity

HK Liquidity Summer: Discussions around DeFi and liquidity infrastructure

On April 11th, we collaborated with esteemed partners from The Spartan Group, Ceffu, Cobo, LTP | LiquidityTech Protocol, Laser Digital, Signum Capital, and Kronos Research, among others. This meeting of minds served as a platform for in-depth discussions on the evolution of DeFi and liquidity infrastructure. Extending our sincere gratitude to our co-organizers, IOSG Ventures and Mirana Ventures, for their invaluable contributions to the success of this event.

Celebrating Bitcoin pizza day

You may recall that on May 22nd, 2010, Laszlo Hanyecz made the first-ever Bitcoin transaction, buying two Papa John's pizzas for 10,000 bitcoins (Yes, you read it right, 10,000 bitcoins).

As a fun nod to this historical moment, Solv decided to host a giveaway event on Galxe. From May 19th to May 26th, we offered $100 worth of SFT funds on our Solv V3 platform. We had ten lucky winners who each walked away with $10 worth of funds.

Excitingly, our community responded with so much enthusiasm that we had a total of 26,327 NFTs minted during this period. Heartfelt appreciation for everyone’s active participation. Stay tuned for more event updates!

Under the Spotlight: Project and Leadership Features

The Spartan Group interviews Ryan: How did a Gen Z entrepreneur craft a "Killer DApp" – an on-chain fund platform

We want to extend our heartfelt thanks to The Spartan Group for conducting a thoughtful and illuminating interview with our co-founder, Ryan. Their conversation provided deep insights into the ethos of Solv and the vision that guides our project.

Ryan highlighted how Solv Protocol emerged from the need to address gaps in the on-chain fund management industry, leading to the creation of the unique ERC-3525 Semi-Fungible Tokens (SFTs). The discussion then covered the evolution of Solv V3 and the challenges the team faced in achieving the right product-market fit.

Ryan also emphasized the importance of a strong, engaged community in Solv's ethos and spoke about the establishment of SFT Labs to provide essential resources for developers. This interview offers a comprehensive look into the DNA of Solv and Ryan's vision for its future. We encourage everyone to check out the full interview.

Smart-Ape and Salazar Shine Lights on Solv: Exploring Growth Metrics and SFT

Big shout-out to Smart-Ape (@the_smart_ape) for the fantastic feature on Solv Protocol. Smart Ape took a deep dive into the ins and outs of our Semi-Fungible Tokens (SFTs), dug up the various use cases, and tracked our growth metrics like Total Value Locked (TVL) and user activity on our marketplace. Smart Ape gave a nod to our awesome partners - Binance Labs and Blockchain Capitals. Cheers to Smart Ape and other key voices like Salazar.eth (@0xSalazar) for spreading the word about Solv Protocol's recent metric leaps and bounds.

Closing

As we soak up the late spring breezes here in the Northern Hemisphere, our team is in high spirits and on the move. From local explorations to more exotic adventures, our team members are spreading out across the globe - from Southeast Asia to the U.S in the months ahead. We're passionate about making connections and growing our community, so always feel free to reach out and connect with us via Twitter (@solvprotocol, @RyanChow_DeFi) or LinkedIn (https://www.linkedin.com/in/ryanchoww/).

Extending our heartfelt thanks to each member of our Solv community. Your trust, participation, and feedback continue to drive our success and inspire our innovation.

Stay tuned for more updates in our next newsletter! Until then, stay safe and happy.

Join Solv Protocol Community

Website |Docs | Twitter | Discord | Telegram | Medium | Newsletter